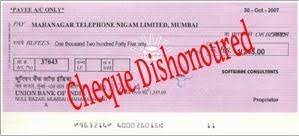

When a cheque is presented to the bank for encashment and if the bank denies or dishonours the payment as mentioned in the bank cheque then that cheque is called as bounced cheque. The literal meaning is that the cheque has bounced back to the issuer or the payee as the bank has not been able to honour the cheque and pay the amount mentioned therein. The reasons for cheque bounce could be;

a) Insufficient funds

b) Defective cheque

c) Signature not matching

d) Stop payment (The issuer has instructed to stop payment for the said cheque)

e) Account is inactive or frozen

f) The cheque is stale (More than 3 months old)

Cheque bounce and cases arising out of it has become so common these days that if one visits the Metropolitan Magistrate Court in Kolkata, he can see for himself the huge number of cases pending before the Hon’ble Court. On an average more than 100 cheque bounce cases are being heard in each Court room in the Bankshall Court. There are more than 4000 banks and NBFC like Magma, Arohan, SREI, United Credit, Allahabad Bank, Uco Bank, United Bank of India, etc. who are having their head quarters in Kolkata and this explains that why there are so many Cheque Bounce cases being heard at Calcutta Metropolitan Magistrate Court every day.

With advent and evolution of banking industry, cheques became a strong instrument to effect payment from one party to another and were regarded as one of the most reliable financial instruments to secure payment. Owing to the reliability and safety of the payment many banks and financial institutions started taking Post Dated Cheques (PDC) as one of the securities for the loans being granted to the borrowers.

Cheque Bounce cases in itself have become a menace not only for the litigants but also for our judicial system. Criminalization of Cheque Bounce cases has opened the floodgates for filing cases at the drop of a hat when a payment is not received by the lender. The number of cases has risen so much (an estimated declared number says more than 1 crore of cases are pending in the trial courts) that it has been opined by the Hon’ble Supreme Court that there should be separate specialised courts dedicated for Section 138 cases.

Another important aspect that was brought in light by Ministry of Finance on 8th June 2020 was a proposal to decriminalize many economic offences including offence under Section 138 of Negotiable Instruments Act, 1881 for dishonour of cheques.

It is a well-known fact that cheque bounce cases are a mechanism to fulfil the civil liability of the payer/borrower through criminal judicial system. Since criminal procedures are allowed hence filing of cases under Section 138 of Negotiable Instrument Act initiates the criminal procedure leading to more hassles for the payer. For example, the basic and primary step is to seek bail as soon as court summon is received by the respondent/accused. And this adds to the financial and logistics woes of the respondent/accused. Let’s have a look to the cheque bounce cases being filed in Kolkata. There are many borrowers from across the country who would have taken loans from banks or NBFC based out of Kolkata. When there is default and a cheque bounce case is filed at Magistrate Court, Calcutta then the accused has to travel from Bangalore, Mumbai, Chandigarh and far away places to seek bail. On one side the accused is already suffering financial constraints and on the other side he shall have to spend on travel and litigation. The worst part of it is that non-appearance post the summons are received can lead to issue of non-bailable warrant against the accused.

Owing to the above scenario in my opinion it would be a wise and humanitarian decision to decriminalize the cheque bounce case as it would certainly lead to lessening the woes and hassles for the litigant/accused.

We should try to evaluate the Sec. 138 cases from the jurisprudence angle too. As mentioned earlier it is all about a civil liability of a payer/borrower and outcome should be more aligned to civil jurisprudence than to criminal but unfortunately these kinds of cases mostly get aligned to criminal side and not to the civil side. It needs to be understood that mostly the borrowers are not able to pay because of loss of income or loss of business which means that the most important criterion of criminal law, mens rea- guilty mind, may not be present in these cases. So, it can be seen that Cheque Bounce cases works like a fudgy logic of information technology. While pleading the accused may plead that he is not in position to pay due to failure or closure of business but he has the intention to pay but still his inability to pay can land him to jail.

It is needless to mention here that in criminal procedure the guilty mind/intention is mandatory and not the guilty act. And here in Sec 138 cases one can see that it works like antithesis of criminal system as it can lead to criminal incarceration even when there is absence of the important element.